Navigating Southeast Asia’s digital frontier: M&A trends in the TMT sector

by Wiljadi Tan

Southeast Asia’s technology, media, and telecommunications (TMT) sector is entering a decisive new phase. As digital adoption deepens, enterprises and investors are shifting from expansion to efficiency – using mergers and acquisitions (M&A) not merely to scale but to build capability, orchestrate ecosystems, and optimise capital.

Through the first three quarters of 2025, deal activity across the region remained resilient despite tighter funding conditions. Strategic buyers dominated, representing more than 90 percent of transactions, while private capital became more selective and structure-driven. The surge in artificial intelligence (AI), cloud, and cybersecurity acquisitions marks a clear transition: Southeast Asian M&A is now defined by capability acquisition rather than capacity growth.

Global technology leaders such as Microsoft, Amazon Web Services (AWS), and Google Cloud have intensified investment in the region, committing billions to AI-ready data centres and cloud hubs in Indonesia, Malaysia, and Thailand. Regional incumbents – notably Singtel and ST Telemedia – are responding with joint ventures and asset recycling, monetising non-core infrastructure to reinvest in higher-margin digital platforms.

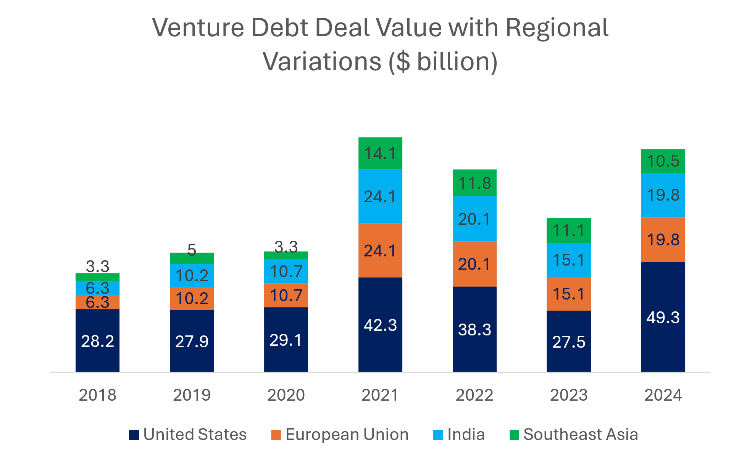

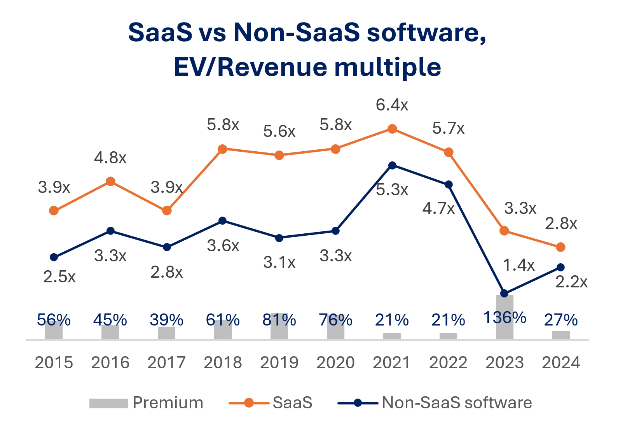

Private equity and venture investors, holding an estimated USD 6 billion in undeployed funds, are focusing on scalable, cash-generative assets. Co-investments, hybrid capital, and venture debt have become preferred structures, reflecting an emphasis on disciplined growth and downside protection. Valuation premiums are now concentrated in business-to-business software as a service (B2B SaaS), AI, and cybersecurity, while consumer-digital assets face greater scrutiny over profitability and cash flow visibility.

Policy momentum is also reshaping the landscape. The forthcoming Association of Southeast Asian Nations (ASEAN) Digital Economy Framework Agreement (DEFA) is expected to harmonise data and investment standards, lowering barriers for cross-border transactions and accelerating intra-ASEAN integration. Singapore continues to anchor regional deal origination, but investment activity is expanding into Indonesia, Vietnam, and the Philippines as capital seeks new depth and diversification.

Looking ahead, Southeast Asia’s M&A cycle is evolving from “growth at all costs” to “growth with control and clarity”. The winners will be those who combine technological depth, operational discipline, and capital agility, turning regional diversity into competitive advantage.

As Protemus Capital’s 2025 report concludes: “Southeast Asia’s digital consolidation story is maturing from expansion to orchestration. The value lies in harmonising technology, infrastructure, and capital to create ecosystems that generate both digital and financial leverage.”

Readers who wish to access the full report, M&A in the TMT Sector in Southeast Asia – September 2025, can find it here.

Wiljadi Tan is Indonesia’s leading exit strategy expert, mastering divestment complexities and bridging owners with investors for successful M&A outcomes. His strategic expertise ensures legacy preservation through informed exits.

/https://storage.googleapis.com/ggi-backend-prod/public/media/7118/8bfea676-65fd-4870-85d3-916f4afffd5e.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/3889/TAN-Wiljadi-Willy-_-Protemus-b&w-square.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/2765/Protemus-Capital_Logo.png)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7138/c32c74c8-06df-4634-b9b3-b7541aafbd58.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7121/3999d493-328a-43b1-91b5-908f9e16839e.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7120/893311ee-73c5-4d60-9d89-999e4d047882.jpg)

/https://storage.googleapis.com/ggi-backend-prod/public/media/7119/6348e5b2-7156-4fb5-83c1-08f7007d0da4.jpg)